5 Game-Changing Lessons from a Tech Hedge Fund Analyst

Investing Secrets I Wish I Had Known Sonner

In today’s post, I want to share with you the 5 important lessons I have learned from a decade of investing in public technology companies. I have made millions of dollars leveraging these insights, but I have also lost millions due to some mistakes.

By reading these lessons, you don’t need to go through the emotional roller coaster and repeat the mistakes I made. 😂

In investing, it’s impossible to make money on every single investment given the uncertainty. If everything is known, there is no such thing as risk reward and upside. But how can one maximize gain and avoid big losses? In my opinion, it’s all about pattern recognition and reflections.

What differentiates a successful investor is the ability to reflect from past successes and mistakes and identify important patterns. It requires intellectual honesty and appropriate reflection.

No two companies are the same, and no two investment decisions are exactly the same. However, history often rhymes.

Over the past decade, I have gained several lessons that I want to share with you. They have stood the test of time.

Lesson No. 1: Investing ahead of the curve is easier said than done. If you are too early, you are wrong.

For the big thematic trends, it usually takes multiple years to play out. As a public equity investor, often times it is not worth putting a large amount of capital on something that is too early to call a trend. There is the opportunity cost of money. Better being a bit late than being wrong.

For example, can you tell even one year in advance that ChatGPT would gain so much traction in early 2023?

If an investment thesis takes years to play out (if you are lucky that they do materialize) or never play out (technology changes so fast, some trends may never materialize), that can lead to meaningful underperformance.

I have found the sweet spot to be entering the market past the third inning.

What does the third inning mean? It means that a new technology or a new concept has got enough traction and can have sustained growth momentum in the medium term.

I would rather be a bit late to a new technology trend (and maybe make 5x return instead of 8x return) than being too early and losing 100%.

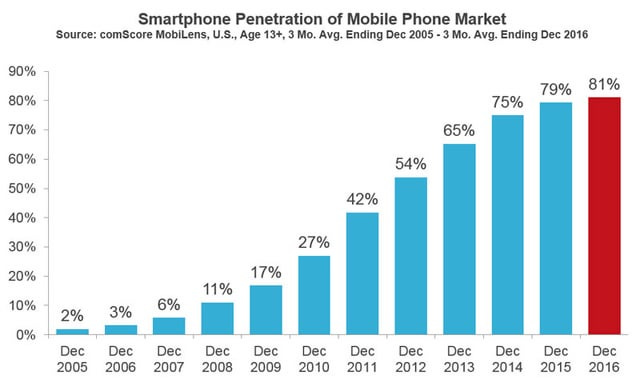

Apple’s stock performance and the smartphone trend are a great example here. Apple launched its first smartphone in 2007. However, the stock price declined by over 50% and took 3 years to get back to where it was. Of course we know it’s due to the Global Financial Crisis (GFC).

But if we focus on the technology trend, we know at the time smartphone penetration was still low in the US at mere 6%. It hasn’t quite reached the pivotal point yet. If an investor didn’t have the strong conviction on smartphone growth as the stock market started selling off, he or she wouldn’t have the courage to hold onto the AAPL shares or even double down when everyone else was panic selling.

However, if one had waited for smartphone penetration to reach low teens % such as in late 2008 through 2010, one would have much higher conviction. Sure, they would have missed the recovery between 2008 and 2010, but the return between 2010 (27% smartphone penetration) and 2020 when smartphone penetration started to plateau was just as good, if not fantastic, at a 700% return (from $10 to $80).

Of course, this is an oversimplified story. AAPL stock has continued to do well despite slowing growth in the overall smartphone market due to the strong ecosystem it has created and expansion in services business, which is more profitable than just selling iPhones and Macbooks.

But if we isolate these other company specific factors and just focus on the big theme here - smartphone adoption, it show that waiting until the 3rd inning is a great high conviction idea.

Generally speaking, we want to focus energy on the thematic trends that have one 1) big enough impact / big enough addressable market and 2) sustained growth. For example, you want to be very careful when investing in a trend if technology adoption grew from 10% to 80% in just 2 years, because timing the market would be difficult.

Sustained growth is all that matters.

Lesson No. 2: Selling stocks should be more decisive than buying.

When to take profits? What do I monitor? Different from buying (waiting until you have more conviction), you should start selling before a meaningful slowdown. But how and what to monitor?

The content below is for paid subscribers only. By becoming a paid subscriber, you will have access to all the articles including company primers with detailed valuation framework and earnings recap notes. You can also claim a one-time free post 😊.

Keep reading with a 7-day free trial

Subscribe to Analyst Journal to keep reading this post and get 7 days of free access to the full post archives.