Taiwan Semiconductor Manufacturing Company (TSMC) Q424 Earnings Recap

Why you should buy TSMC instead of NVDA if you can only invest in one semiconductor company.

If you have enjoyed reading this article, please consider liking, restacking, or sharing with your friends! Your engagement is the biggest support. ❤️

Hi fellow investors! Today we are discussing TSM (Taiwan Semiconductor Manufacturing Company) as part of the earnings recap series. In my opinion, TSMC is the BEST WAY to invest in the semiconductor industry, even more so than NVDA. You will find out why in the note below.

In the full note, I am also sharing a detailed valuation framework and updated buy/sell price to help you maximize upside and minimize downside. I called out the peak of Broadcom’s share price ($241) in this note published in early January. You can view a FREE SAMPLE of the valuation framework in my AMD deep dive here.

We will be publishing more technology companies’ earnings recap in the following weeks. Subscribe below so you don’t miss the timely and in-depth stock analysis!

TSMC ($890B market cap) Quick Earnings Recap

TSM’s revenue and gross margin came above consensus estimates

Q424 Revenue $26.88B was in line with consensus (they report monthly revenue, so upside is already in consensus), beat their own guidance $26.1-$26.9B.

Q424 Gross Margin 59.0% beat consensus at 58.5% and guidance 57-59%.

Q125 Revenue guide $25.4B vs consensus $24.6B.

Q125 Gross Margin guide 58% vs consensus 57%.

CY25 Revenue guide mid 20s% growth vs consensus 22%.

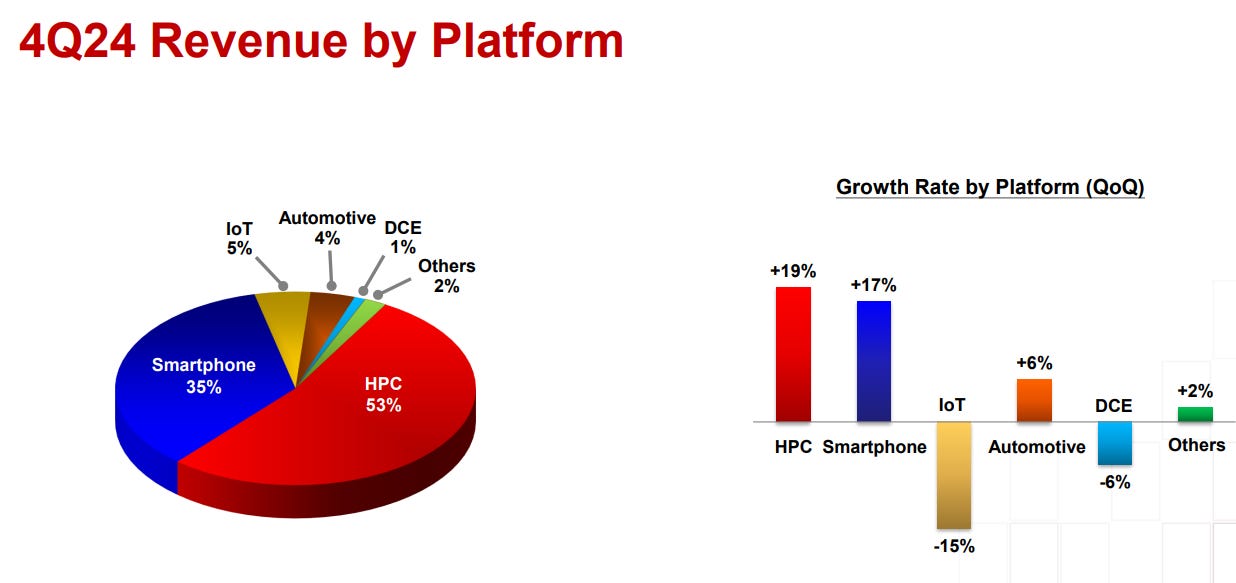

Revenue Results by End Markets

HPC (high performance compute) was the biggest segment, 53% of total revenue, and grew 19% quarter-over-quarter (qoq). This shouldn’t come as a surprise. TSMC is the exclusive wafer supplier for NVDA’s data center GPUs. As long as AI demand stays firm, TSM should see positive trends in its HPC segment. Besides NVDA GPUs, this segment also supplies to AMD’s GPU and general server CPUs , Broadcom’s ASICs and networking chips.

Smartphone was the second largest segment, 35% of total revenue, and grew 17% qoq. The sequential growth was mostly driven by favorable seasonality. New iPhone launch takes place in September each year so usually Sept-Q and Dec-Q are stronger quarter for smartphone supply chain companies.

Smartphone and HPC together contributes 88% of TSM’s total revenue. The rest is IoT, Automotive and others.

Stock Key Debates

Despite all the various segments, only 2 things matter to the TSMC stock right now: the sustainability of AI strength and Gross Margin %.

Why does these two matter the most?

Transitioning from Smartphone Driven to AI Driven Growth

Historically, TSMC’s largest revenue exposure in smartphone. Before AI takes off, what supports TSMC’s long term growth is the technology advancement in smartphone.

Each new iPhone comes with process node advancement. 5 years ago, when Apple launched iPhone 11, the chip inside the Phone was A13 Bionic chip (you can visit Apple’s official website for the technical specifications).

This A13 chip was designed by Apple and manufactured by TSMC using 7nm technology. Fast forward to the more recent launch of iPhone 16. It’s A18 Bionic chip designed by Apple and manufactured by TSMC using 3nm technology.

In the semiconductor supply chain, the shrinking of process node from 7nm, to 5nm, and now to 3nm and 2nm is what drives the improved performance of our every day electronic products.

Essentially, the transistors on a semiconductor chip are being shrunk to a smaller size. As these components are getting smaller and denser, the smaller transistors can switch faster and process data more efficiently. At the same time, as more transistors can be placed on the same sized physical space, you can improve the performance of chips without increasing the size.

That’s the core of technology development, and essentially why the computers are much smaller today than the ones from the 90s.

Technology Advancement Supports Wafer Price Increase

How is this relevant to TSMC? TSM is at the forefront of technology advancement. In order to keep shrinking the process node, TSMC has to invest a lot of capital to push the technology limit.

In return, as the technology leader, TSMC is able to charge higher prices for the new leading edge wafers from its customers, including Apple and Nvidia. (I will write more on wafers later, but for now you can simply think of wafers as the source of semiconductor chips).

On a very high level, TSMC’s revenue = wafer price x wafer volume.

The below content is available for paid subscribers only. We will discuss the key drivers for TSM right now, takeaways from earnings, why TSMC is a better investment than NVDA, and updated BUY / SELL price. Trust me, it will be well worth it! (subscription only costs 2 cups of coffee).

Keep reading with a 7-day free trial

Subscribe to Analyst Journal to keep reading this post and get 7 days of free access to the full post archives.