When to buy and sell Supermicro stock?

💥Buy and sell price for Supermicro included in the full article💥

In the previous piece, we discussed the brief history of Supermicro and why the stock had gone to the moon during the AI mania. 🚀🚀

In this piece, we will discuss why the stock has plunged down (-80% ‼️)

At what price should you buy and sell the stock? 🤔🤔

Disclaimer: opinions my own, not financial advice.

Previously… why did the stock go to the moon🚀🚀?

In early 2023, ChatGPT first made the general public aware of the large language model and the potential use cases for AI. Many companies saw the huge commercial potential from AI and they strive to train their own large language models to stay in the leading position of this AI battle.

In order to train the large language models, you need significantly more compute power ‼️, which requires GPU (more on GPU later, subscribe so you don’t miss my deep dive on 💥GPU and Nvidia💥).

The sudden demand for GPU and AI servers caught many by surprise, including those in the server supply chain (we explained the role that Supermicro played in this ecosystem in the last article. Click here for more).

Supermicro has a good long-term relationship with Nvidia and invested in designing AI servers earlier than server competitors such as Dell and Hewlett Packard Enterprise (HPE). So they were able to get good allocation of GPU and provide AI servers to the large hyperscale customers.

Stock woes … why though?

Then this begs the question, why has the stock come down 80% from peak? There are three problems. 🚩🚩🚩

🚩First, intense competition. 🚩

Even though Supermicro had a first mover advantage, eventually other server makers do catch up and Dell started supplying AI servers to its customers as well. With the increasing competition, Supermicro’s gross margin and operating margin started to come down, with its gross margin shrinking from 17-18% to 11-13% in the recent quarters.

Sure, you do need expertise and design capabilities to make AI servers, but it’s not rocket science. With time and capital invested in AI servers, Dell has quickly caught up in terms of AI orders. Not to mention the Taiwan based ODMs (more on ODM here) that also have a strong long-standing relationship with the US hyperscale customers. As I mentioned in the last piece, the server competition is competitive.

🚩Second, corporate governance issues. 🚩

Supermicro still hasn’t filed its annual report yet for 2024 even though its fiscal year 2024 ended back in Jun 30, 2024. Its previous auditor Ernst & Young resigned in Oct 2024, citing concerns around its governance, transparency and internal control over financial reporting.

This is not a great look.

When your own auditor refused to sign their name and be responsible for what’s published on the annual report. What narrative does it bring?

Usually when companies have issues with financial reporting, it could be aggressive accounting - for example, recognizing revenue earlier than it should be or underestimating expenses to boost the bottom line.

In fact, this is not the first time that Supermicro is reported to have corporate governance issues. In 2019, Supermicro also had trouble filing for its annual report on time and eventually got delisted by Nasdaq. Although it eventually made its way back in early 2020.

🚩Third, will all the elevated investments into AI infra continue? 🚩

This is a billion dollar question and not unique to Supermicro. Will investments in AI take a pause? Right now cloud hyperscalers are spending billions of dollars each quarter in the AI Arms Race. Remember, just one AI server costs ~$300K or more vs a general server of just several thousands. To use AI servers, you also have to spend a ton of money paying for the infrastructure including power costs. Things add up.

Eventually these companies have to justify all these investments. If the return on investment isn’t great, why should they keep pouring $$ into these AI infrastructure build?

When they do take a pause, we would see a decline in these AI ecosystem suppliers’ revenue.

In the following section below (for paid subscribers only), we will dissect these questions in detail and analyze things from a financial lens. 🔍

Quick answer to the question that I asked earlier - should you even invest in the stock?

My answer is: yes, at the right price.

Despite the concerns mentioned above, AI is here to stay, and AI servers play a critical role in the ecosystem. Currently less than 5% of the servers being shipped are AI servers, suggesting that there are still a large part of the server market that could be converted to AI servers.

Sure, there is competition, but Supermicro is also working on providing more value-add to differentiate itself such as liquid cooling solutions. Servers generate a lot of heat, and right now the cooling systems being adopted is air cooling. However, with new generation of AI servers and the significant amount of power being generated, air cooling can no longer effectively dissipate the heat. Liquid cooling becomes increasingly important as the power consumption goes up significantly for each new generation of AI servers.

Plus, even though the gross margin percentage goes down, the gross profit dollars still goes up meaningfully. For example, Supermicro’s quarterly revenue today is ~$6B and GM% (Gross margin percent of revenue) is 13.3%. Assuming that revenue goes up 50% based on the increasing penetration of AI server and GM% goes down to 10%. That means gross profit dollars moves from $790M ($6B x 13.3%) to $950M ($9.5B x 10%). Assuming operating expense doesn’t grow as fast, there is still some decent expansion in operating income (mid 20%).

Corporate governance does remain a concern, but delisting doesn’t mean the company’s value goes to 0. So I would consider this as a risk and take a lower valuation multiple to incorporate the risk. Supermicro is also working on this matter by finding a new auditor called BDO (this explains why the stock was up 65% in the last 5 days. If they can successfully file the 10K, I suspect near term overhang on the stock can be removed, and provide a support to its P/E multiple.

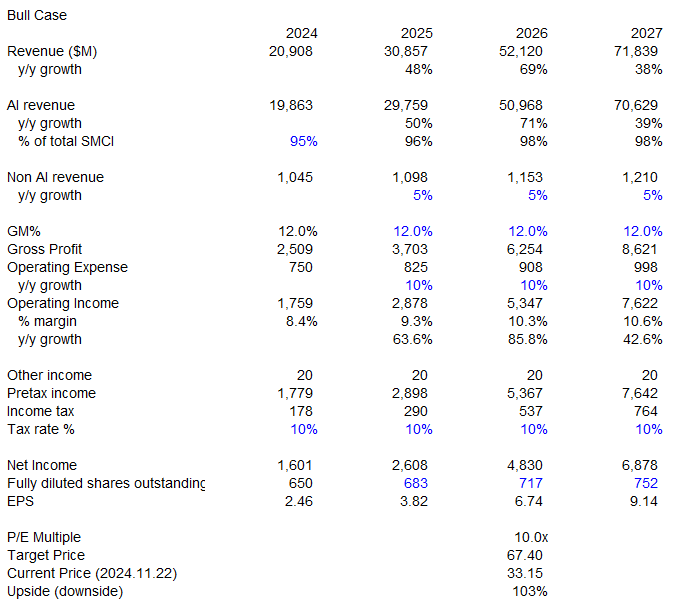

Bull Case🐂📈📈

What happens to earnings power if AI server shipment continue to grow strongly and Supermicro maintains a relatively healthy market share and pricing?

I am assuming AI revenue to grow at 50%+ for the next two years, thanks to both increase in ASP (average selling price) by 5% every year as well growth in AI server shipment for Supermicro (40-60% growth each year). I am assuming total AI server market to grow and Supermicro’s market share to grow by 50 basis points each year.

Currently l estimate AI server penetration is only 3.8%. I am assuming that it will continue to grow to reach 10% by 2027.

Due to a healthy AI server demand and Supermicro’s unique liquid cooling solutions, I am estimating a relatively healthy gross margin for Supermicro.

Here I have gross margin maintained at 12%. I am assuming a steady 10% growth in operating expense.

My earnings power for Supermicro is $6.74 for 2026 from $2.5 this year. 💥💥🤯🤯

Historically Supermicro’s P/E multiple has traded between 6x and 12x. I am using 10x for the bull case. The target price is $67.4, which represents 103% upside from here.

The below content is for paid subscribers only. I will walk through the bear case as well as the buy / exit price for SMCI.

Keep reading with a 7-day free trial

Subscribe to Analyst Journal to keep reading this post and get 7 days of free access to the full post archives.